AUDUSD is massively affected by Australian economic reports such as Australia Current Account, Australia Private Sector Credit (MoM), Building Approvals (MoM) and Building Approvals (YoY). AUDUSD has been moving with bearish bias within the descendant channel and considering the Fibonacci retracement it is so soon to consider this short term growth as a reversal pattern. Now the support lies at 0.71610 with resistance at 0.72910 which both lines are below the monthly pivot point at 0.7644. The EMA of 10 is located below the EMA of 75 confirming the recent bearish moves. The RSI and ADX are showing price growth while the MACD is in negative territory signaling the price fall. Traders can give themselves a rest a wait for a better chart setup to trade.

https://fxglory.com/audusd-analysis-for-31-05-2016/

Tuesday, May 31, 2016

NZDUSD analysis for 31.05.2016

As the American market was closed on Memorial Day, NZDUSD is chiefly under the influence of New Zealand economic reports such as: Building Permits MoM, NBNZ Business Confidence, NBNZ Activity Outlook and M3 Money Supply. On Monday NZDUSD had a sharp fall but later it moved back up and today it continued its bullish trend however there was a pullback right after that. The support lies at 0.66820 with resistance at 0.67540 which both lines are below the monthly pivot point at 0.6930. The MACD indicator is in negative territory and the RSI is in the neutral zone. The EMA of 10 is located below the EMA of 75 confirming the bearish scenario of the recent days. Short positions are recommended at this moment.

https://fxglory.com/nzdusd-analysis-for-31-05-2016/

https://fxglory.com/nzdusd-analysis-for-31-05-2016/

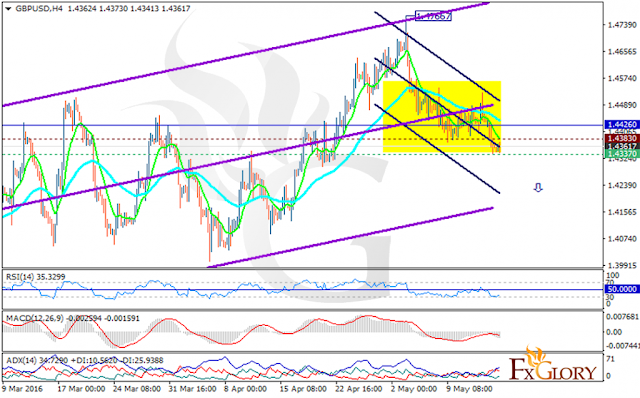

GBPUSD analysis for 31.05.2016

Market was not quite active for GBPUSD yesterday due to the Memorial Day. Yesterday the price fell at first but soon changed its direction to upward and today it rose higher. The support lies at 1.46250 with resistance at 1.47470 which both lines are above the monthly pivot point at 1.44260. The MACD indicator is in positive territory, the RSI is above the neutral zone and the ADX is showing stronger buyers than sellers. Moreover the EMA of 10 is moving above the EMA of 75 suggesting the bullish tendency of the chart in the last recent days. Long positions are recommended with the target at 1.4724.

https://fxglory.com/gbpusd-analysis-for-31-05-2016/

https://fxglory.com/gbpusd-analysis-for-31-05-2016/

EURJPY analysis for 31.05.2016

EURJPY is under the influence of some economic reports such as Real Household Spending (YoY), Unemployment Rate, Job-to -Applicant Ratio, Industrial Production (MoM) and Industrial Production (YoY) in Japan. Yesterday EURJPY moved with bullish bias but today it created a choppy pattern. The support lies at 123.310 with resistance at 124.350 which both lines are above the weekly pivot point at 122.700. The EMA of 10 is headed upward crossing the EMA of 75 but both lines are below the EMA of 200. All indicators are signaling buy opportunity; the MACD indicator is in positive territory, the RSI is above the 50 level and the ADX is showing strong buyers. The resistance level breakout will push the price in higher ranges targeting 125 however there might be a pullback any time soon.

https://fxglory.com/eurjpy-analysis-for-31-05-2016/

https://fxglory.com/eurjpy-analysis-for-31-05-2016/

EURUSD analysis for 31.05.2016

Due to the American Holidays USD pairs are moving slowly and for EURUSD the story is the same but USD is still supported by the Yellen’s speech so the downward momentum may stay for a while. Not only the pair is falling down the descendant channel, it is also creating a choppy pattern leaving lower highs and lower lows. The support is at 1.11260 with resistance at 1.11620 and the weekly pivot line is resting in between at 1.11420. The MACD indicator is in negative territory and the RSI is below the 50 level. The EMA of 10 is located below the EMA of 75 confirming the bearish scenario of the last recent days. The support level breakthrough will pave the way for further decline to 1.1070.

https://fxglory.com/eurusd-analysis-for-31-05-2016/

https://fxglory.com/eurusd-analysis-for-31-05-2016/

Monday, May 30, 2016

USDCAD analysis for 30.05.2016

As there is no important economic reports in the US and Canada, USDCAD will be less active today. Since the previous low at 1.29096, USDCAD has been moving with bullish bias along with several pullbacks on the way. The support rests at 1.30530 with resistance at 1.31160 which both lines are above the monthly pivot point at 1.27550. The EMA of 10 is above the EMA of 75 pointing to the recent price growth. The RSI is in neutral zone, the Stochastic is showing upward momentum and the ADX is showing stronger buyers than sellers. The pair may continue its upward movement within Andrews’ pitchfork. Long positions are recommended with the target at 1.2997.

https://fxglory.com/usdcad-analysis-for-30-05-2016/

https://fxglory.com/usdcad-analysis-for-30-05-2016/

USDCHF analysis for 30.05.2016

As there were no important economic reports in the US, traders are looking at Switzerland Employment Level index which affects USDCHF. It worth mentioning that Yellen’s speech supported USD. This pair is climbing up the ascendant channel since the previous low at 0.94442. The support lies at 0.99350 with resistance at 0.99590 which both lines are above the monthly pivot point at 0.9628. The EMA of 10 is above the EMA of 75 showing the recent price growth. All indicators are signaling buy opportunity; the MACD is in positive territory, the RSI is above the neutral area and the ADX is showing stronger buyers than sellers. The upward move will continue and buyers can target 1.0020.

https://fxglory.com/usdchf-analysis-for-30-05-2016/

https://fxglory.com/usdchf-analysis-for-30-05-2016/

EURUSD analysis for 30.05.2016

EUR is getting weak against the strong USD especially after the Fed Chairman speech, Janet Yellen, who supported USD. Since the previous high at 1.16155, EURUSD has been falling down the descendant channel in a choppy pattern. The support rests at 1.10870 with resistance at 1.11230 which both lines are below the weekly pivot point at 1.11420. The EMA of 10 is located below the EMA of 75 suggesting the current bearish momentum. All indicators are signaling sell opportunity; the MACD indicator is in negative territory, the RSI is below the neutral area and the ADX is showing strong sellers. The resistance level breakout will confirm this bottoming otherwise the price will continue its decline. Short positions are recommended with the target at 1.1070.

https://fxglory.com/eurusd-analysis-for-30-05-2016/

https://fxglory.com/eurusd-analysis-for-30-05-2016/

GBPUSD analysis for 30.05.2016

GBPUSD is under the influence of the UK Consumer Confidence Index and the 10-year government bonds yield which decreased. This pair is moving in neutral zone and by breaking the resistance line it will move in bullish bias and on the other hand the support level breakthrough will push the pair to lower ranges. The support lies at 1.45840 with resistance at 1.46460 which both lines are above the monthly pivot point at 1.4426. The RSI is located in the neutral zone, the ADX is showing stronger sellers than buyers and the Stochastic is not showing any momentum. While indicators are not showing any clear signal, the price may continue climbing up the ascendant channel or fall down within Andrews’ pitchfork. The EMA of 10 is above the EMA of 75 confirming the recent price growth. Traders can wait for a better chart setup to decide on their position however the price might have further decline to 1.4560.

https://fxglory.com/gbpusd-analysis-for-30-05-2016/

https://fxglory.com/gbpusd-analysis-for-30-05-2016/

USDJPY analysis for 30.05.2016

Today there won’t be lots of economic reports to affect USDJPY however this pair will be under the influence of Japan Retail Sales y/y and National Consumer Price Index which has remained intact. USDJPY ended the week with bullish bias and today as the market opened it continued its upward trend. The support rests at 110.560 with resistance at 111.420 which both lines are above the weekly pivot point at 110.04. The MACD indicator is in positive territory, the RSI is above the 50 level and the ADX is showing strong buyers. Moreover the EMA of 10 is moving above the EMA of 75 confirming the bullish scenario. It seems that this pair will be climbing up the ascendant channel. Long positions are recommended with the target at 110.60.

https://fxglory.com/usdjpy-analysis-for-30-05-2016/

https://fxglory.com/usdjpy-analysis-for-30-05-2016/

Friday, May 27, 2016

USDCHF analysis for 27.05.2016

USDCHF is massively under the influence of Switzerland’s industrial production. This pair has been moving with bullish bias climbing the ascendant channel. Now the support lies at 0.98790 with resistance at 0.99190 which both lines are above the weekly pivot point at 0.98580. The price is above the Ichimoku Cloud and the Chinkou Span. The Tenkan-sen is showing a downward movement while the Kijun-sen is showing a horizontal movement. The MACD indicator and the RSI are in neutral zone but the Stochastic is showing upward trend. The EMA of 10 is above the EMA of 75 and it seems that there is strong resistance at 0.99 area. Pullbacks can happen at any time soon. The support level breakthrough will pave the way for further decline targeting 0.9860.

https://fxglory.com/usdchf-analysis-for-27-05-2016/

https://fxglory.com/usdchf-analysis-for-27-05-2016/

USDJPY analysis for 27.05.2016

USDJPY is affected by some economic data such as corporate services price index, Durable Goods Orders and Initial Jobless Claims. As the chart shows, there was a sharp fall yesterday followed by two bullish candles and a pullback after. Today it rose a little bit but created a negative candle right away. The support lies at 109.660 with resistance at 110.100 which both lines are above the monthly pivot point at 108.380. Candles have created a rising wedge which suggests and price decline in the future. The MACD indicator and the RSI are both in neutral zone not providing any clear signal for traders. The EMA of 10 is located above the EMA of 75 showing the growth of price in the recent days. Considering the H4 chart with this rising wedge the downward trend will continue until it reaches 109.00.

https://fxglory.com/usdjpy-analysis-for-27-05-2016/

https://fxglory.com/usdjpy-analysis-for-27-05-2016/

EURUSD analysis for 27.05.2016

Although the decline of 10-year government bonds in Germany weakened Euro, EURUSD is being supported due to the growth of “risk appetite’ in the world. Yesterday despite the pair’s effort to move in bullish bias there were many pullbacks on the way. Now the support rests at 1.11720 with resistance at 1.12050 which both lines are below the weekly pivot point at 1.12420. The EMA of 10 is moving below the EMA of 75 suggesting the price movement in lower ranges in recent days. The RSI is getting above the 50 level, the MACD indicator is in neutral territory and the ADX is showing strong buyers. Unfortunately there is no strong signal for traders at the moment; however the pair may continue its upward trend within Andrews’ pitchfork. If traders cannot wait for a better chart setup, long positions are recommended with the target at 1.1300.

https://fxglory.com/eurusd-analysis-for-27-05-2016/

https://fxglory.com/eurusd-analysis-for-27-05-2016/

GBPUSD analysis for 27.05.2016

GBPUSD is chiefly under the influence of UK’s economic reports such as UK’s gross domestic product estimation and Britain’s GfK consumer confidence index. Once again GBPUSD is creating a zigzag pattern leaving ups and downs in a row. At the moment the support rests at 1.46310 with resistance at 1.47060 which both lines are above the weekly pivot point at 1.4485. The EMA of 10 is located above the EMA of 75. After yesterday’s high at 1.47371 this pair has been moving with bearish bias and may continue its downward trend within Andrews’ pitchfork. The Stochastic is not showing any clear signal for traders however it is not in high ranges. The support level breakthrough will smooth the way for further decline to 1.4480.

https://fxglory.com/gbpusd-analysis-for-27-05-2016/

https://fxglory.com/gbpusd-analysis-for-27-05-2016/

Thursday, May 26, 2016

Technical analysis of GBPJPYdated 26.05.2016

GBPJPY has been moving with bullish bias since 6th of May and it seems that this pair is going to continue its rally up the ascendant channel within the Andrews’ pitchfork. However after hitting the previous high at 162.492 there might be pullbacks at any time soon. The support lies at 160.43 with resistance at 162.320 which both lines are above the weekly pivot point at 158.82. The EMA of 10 is located above the EMA 75 showing the recent price growth. All indicators are signaling buy opportunity; the MACD is in positive territory, the RSI is above the 50 level and the ADX is showing stronger buyers than sellers. The resistance level breakout will smooth the way for further growth. At the moment, long positions are recommended with the target at 162.55.

https://fxglory.com/technical-analysis-of-gbpjpydated-26-05-2016/

https://fxglory.com/technical-analysis-of-gbpjpydated-26-05-2016/

Technical analysis of USDCHF dated 26.05.2016

USDCHF is massively affected by some economic data in Switzerland such as Switzerland’s UBS consumption indicator, the ZEW economic expectations and Switzerland’s Q1 industrial production data. USD/CHF is rallying up the ascendant channel but it is not showing any momentum for further rise. The support rests at 0.98770 with resistance at 0.99070 which both lines are above the monthly pivot point at 0.9628. The EMA of 10 is above the EMA of 75. All indicators are showing price decline. The MACD indicator is in neutral territory, the RSI is close to the 50 level, the Stochastic is confirming the bearish trend and the ADX is showing stronger sellers. Short positions are recommended with the target at 0.9980.

https://fxglory.com/technical-analysis-of-usdchf-dated-26-05-2016/

https://fxglory.com/technical-analysis-of-usdchf-dated-26-05-2016/

Technical analysis of GBPUSD dated 26.05.2016

GBPUSD is under the influence of some economic reports such as exports and GDP for GB and durable goods and pending home sales for US. Since 23rd of May GBPUSD has been rallying up the ascendant channel and we can only see a few pullbacks. The support rests at 1.46940 with resistance at 1.47260 which both lines are above the weekly pivot point at 1.44850. The EMA of 10 is located above the EMA of 75. All indicators are signaling price growth, the MACD indicator is in positive territory and the RSI is above the 50 level. Long positions are recommended with the target at 1.4880.

https://fxglory.com/technical-analysis-of-gbpusd-dated-26-05-2016/

https://fxglory.com/technical-analysis-of-gbpusd-dated-26-05-2016/

Technical analysis of EURUSD dated 26.05.2016

Good economic reports in Euro zone such as the growth of Business Climate in Germany are supporting EUR today. EURUSD moved with bullish bias yesterday and today continued its rally up to the resistive zone and now is creating and negative candle. The support lies at 1.11570 with resistance at 1.11970 which both lines are below the weekly pivot point at 1.12420. The price is under the Ichimoku Cloud and the Chinkou Span. The Tenkan-sen is showing a downward movement while the Kijun-sen is suggesting a horizontal movement. The MACD indicator is in negative zone showing the bearish tendency of the trend and the RSI is below the 50 level confirming this bearish scenario. Short positions are recommended with the target at 1.1130.

https://fxglory.com/technical-analysis-of-eurusd-dated-26-05-2016/

https://fxglory.com/technical-analysis-of-eurusd-dated-26-05-2016/

Wednesday, May 25, 2016

Technical analysis of EURJPY dated 25.05.2016

EURJPY is chiefly under the influence of European market because there is no important economic news in Japan today. European report include: ECOFIN Meetings, German 30-y Bond Auction, German Ifo Business Climate, and GfK German Consumer Climate. The pair is testing the resistance level at the moment but considering the long term chart it is not going to rally up. The support rests at 122.420 with resistance at 122.900 which both lines are below the weekly pivot point at 123.470. All indicators are signaling sell opportunity, the MACD is in negative territory, the RSI is below the 50 level. The EMA of 10 is located below the EMA of 75 confirming the current price decline. The resistance level breakout will push the price in higher rangers targeting 124.

https://fxglory.com/technical-analysis-of-eurjpy-dated-25-05-2016/

https://fxglory.com/technical-analysis-of-eurjpy-dated-25-05-2016/

Technical analysis of GBPUSD dated 25.05.2016

GBP is being supported by the growth of the 10-year government bonds yield. GBPUSD is massively under the influence of the parliamentary hearings on inflation in the UK. GBPUSD has been moving in neutral zone and yesterday it rose to 1.46400 but today it fell and is moving in lower ranges. This fall can be regarded as a short term pullback creating a buy opportunity. The support rests at 1.45910 with the resistance at 1.46330 which both lines are above the weekly pivot point at 1.4485. The EMA of 10 has surpassed the EMA 75. All indicators are showing price growth for now. The price is above the Ichimoku Cloud and the Chinkou Span. The Tenkan-sen is showing a horizontal movement while the Kijun-sen is showing an upward movement. The MACD indicator is in positive territory, the RSI is above 50 level and the ADX is showing strong buyers. Long positions are recommended with the target at 1.4760.

https://fxglory.com/technical-analysis-of-gbpusd-dated-25-05-2016/

https://fxglory.com/technical-analysis-of-gbpusd-dated-25-05-2016/

Technical analysis of USDJPY dated 25.05.2016

As the USD is getting stronger than JPY, this pair is affected by the US New Home Sales report. USDJPY ended the bearish trend yesterday and moved with bullish bias but it fell again today morning. The pair is finding support at 109.530 with resistance at 110.490 which both lines are above the monthly pivot point at 108.380. The EMA of 10 is moving above the EMA of 75 suggesting the current price growth. All indicators are signaling buy opportunity. The MACD indicator is in positive territory, the RSI is above the 50 level and Stochastic is showing strong buyers. It seems that this pair is going to climb up the ascendant channel within Andrews’ pitchfork. While there might be a pullback at any time soon, buyers can target 110.60 at the moment.

https://fxglory.com/technical-analysis-of-usdjpy-dated-25-05-2016/

https://fxglory.com/technical-analysis-of-usdjpy-dated-25-05-2016/

Tuesday, May 24, 2016

Technical analysis of USDCAD dated 24.05.2016

USDCAD is massively under the influence of oil market. This pair has been climbing the ascendant channel within Andrews’ pitchfork after the previous low at 1.24584 and there will be a pullback at any time soon. The support lies at 1.31090 with resistance at 1.32020 which both lines are above the weekly pivot point at 1.30710. All indicators are signaling buy opportunity; the MACD indicator is in positive territory, the RSI is above 50 level and the ADX is showing strong buyers. The EMA of 10 is located above the EMA of 75 confirming the recent price growth. Long positions are recommended with the target at 1.3218.

https://fxglory.com/technical-analysis-of-usdcad-dated-24-05-2016/

https://fxglory.com/technical-analysis-of-usdcad-dated-24-05-2016/

Technical analysis of AUDUSD dated 24.05.2016

AUDUSD tried to move in bullish bias on 19th of May but bears took the control of the chart on 23rd of May and continued the long term bearish pattern. This pair is moving in lower ranges finding support at 0.71380 with resistance at 0.72610 which both lines are below the monthly pivot point at 0.7644. All indicators are showing price decline, the MACD indicator is in negative territory, the RSI is below the 50 level and ADX is showing strong sellers. The EMA of 10 is located below the EMA of 75 confirming the price fall over the last recent days. The price is getting closer to the support level and the support level breakthrough will smooth the way for further decline. Considering this scenario, short positions are recommended.

https://fxglory.com/technical-analysis-of-audusd-dated-24-05-2016/

https://fxglory.com/technical-analysis-of-audusd-dated-24-05-2016/

Technical analysis of GBPUSD dated 24.05.2016

There were no important economic reports yesterday for Britain, however, GBPUSD is chiefly under the influence of bonds yield differential between the US and the UK. GBPUSD is moving in neutral zone and it is hard to predict the next trend. The support rests at 1.4474 with resistance at 1.45040 which both lines are above the monthly pivot point at 1.44260. The EMA of 10 has reached the EMA of 75 and they are both moving in neutral area. The MACD indicator and the RSI are in negative territory but very close to the neutral zone. Traders can wait for stronger signals however, short positions can be recommended after the support level breakthrough targeting 1.4320.

https://fxglory.com/technical-analysis-of-gbpusd-dated-24-05-2016/

https://fxglory.com/technical-analysis-of-gbpusd-dated-24-05-2016/

Technical analysis of EURUSD dated 24.05.2016

EURUSD is affected by Services PMI in Germany and Manufacturing PMI in Germany. This pair, despite its effort to turn into a bullish pattern on Monday, made bearish moves and now is moving with bearish bias as well. The support lies at 1.11970 with resistance at 1.12230 which both lines are below the weekly pivot point at 1.12420. The EMA of 10 is moving below the EMA of 75 which shows the price decline over the last recent days. The MACD indicator is in negative territory and the RSI is below the 50 level. The price is under the Ichimoku Cloud and the Chinkou Span. The Tenkan-sen and the Kijun-sen are both showing a horizontal movement. Short positions are recommended with the target at 1.1130.

https://fxglory.com/technical-analysis-of-eurusd-dated-24-05-2016/

https://fxglory.com/technical-analysis-of-eurusd-dated-24-05-2016/

Monday, May 23, 2016

Technical analysis of EURJPY dated 23.05.2016

EURJPY is under the influence of Japan All Industries Activity m/m and Euro is publishing Consumer Confidence (M/M). The pair is moving around the 123.00 levels, trying to break the support. The support lies at 122.600 with resistance at 123.630 which both lines are below the monthly pivot point at 123.84. All indicators are signaling price fall. The RSI is below the 50 level, the Stochastic is showing price decline and the ADX is showing strong sellers. The EMA of 10 is staying close to the EMA of 75 in the neutral area. Short positions are recommended with the target at 121.40.

https://fxglory.com/technical-analysis-of-eurjpy-dated-23-05-2016/

https://fxglory.com/technical-analysis-of-eurjpy-dated-23-05-2016/

Technical analysis of USDJPY dated 23.05.2016

USDJPY is under the influence of some economic reports such as Flash Manufacturing PMI for the US and Japan is publishing Flash Manufacturing PMI, Trade Balance and All Industries Activity m/m. This pair has been climbing up the ascendant channel since the beginning of May. The support rests at 109.400 with resistance at 110.300 which both lines are above the monthly pivot point at 108.380. The EMA of 10 is located above the EMA of 75. The MACD indicator and the Ichimoku are signaling buy opportunity. The price is above the Ichimoku Cloud and the Chinkou Span. The Kijun-sen is showing a horizontal trend while the Tenkan-sen shows an upward movement. The MACD indicator is in positive territory and the RSI is staying in neutral zone. While these indicators are suggesting long positions the price is getting close to the support level and the support level breakthrough can push the price to lower ranges. Short positions are recommended with the target at 109.00.

https://fxglory.com/technical-analysis-of-usdjpy-dated-23-05-2016/

https://fxglory.com/technical-analysis-of-usdjpy-dated-23-05-2016/

Technical analysis of GBPUSD dated 23.05.2016

GBPUSD is chiefly affected by the UK Industrial Trends Survey – Orders announcement. Moreover, the Pound has gained momentum due to the poll which 52% of people voted against Brexit. GBPUSD has been moving in neutral area for a while. The support lies at 1.44870 with resistance at 1.4539 which both lines are above the monthly pivot point at 1.4426. The EMA of 10 is above the EMA of 75 but is getting close to it in the neutral zone. Considering the long term chart the price is climbing the ascendant channel on the other hand, due to the recent pivot points the price may fall along with the Andrews’ pitchfork. The MACD indicator is showing price growth while the RSI is staying in neutral zone. There is no clear signal for this pair at the moment but the support level breakthrough will lead the pair to lower levels to reach 1.4240 and on the upside, the resistance level breakout will push the price to higher ranges targeting 1.4670.

https://fxglory.com/technical-analysis-of-gbpusd-dated-23-05-2016/

https://fxglory.com/technical-analysis-of-gbpusd-dated-23-05-2016/

Technical analysis of EURUSD dated 23.05.2016

EURUSD is under the influence of Germany PPI and the US Markit Manuf PMI for today. This pair has been moving with bearish bias since the previous high at 1.16155 and now is finding support at 1.12050 with resistance at 1.12590 which both lines are below the monthly pivot point at 1.13740. The EMA of 10 is located below the EMA of 75 showing the price bearish tendency in the last recent days. The pair is falling down the descendant channel and both indicators are confirming the bearish scenario. The MACD indicator is in negative territory and the RSI is below the neutral zone. The support level breakthrough will smooth the way for further decline to 1.1070.

https://fxglory.com/technical-analysis-of-eurusd-dated-23-05-2016/

https://fxglory.com/technical-analysis-of-eurusd-dated-23-05-2016/

Technical analysis of EURUSD dated 20.05.2016

Euro is losing power due to the German 10-year bonds yield and the ECB protocols report. EURUSD is finding support at 1.11880 with resistance at 1.12440 both lines are below the weekly pivot point at 1.13250. The pair is falling down the descendant channel; the EMA of 10 is below the EMA of 50 showing the price movement in lower ranges in recent days. The MACD indicator is in negative territory and the RSI is below the 50 level. The price is under the Ichimoku Cloud and the Chinkou Span. The Tenkan-sen and the Kijun-sen are showing a horizontal movement. The support level breakthrough will pave the way for further decline to 1.1040 .

https://fxglory.com/technical-analysis-of-eurusd-dated-20-05-2016/

https://fxglory.com/technical-analysis-of-eurusd-dated-20-05-2016/

Technical analysis of USDCHF dated 20.05.2016

USDCHF is under the influence of the US economic reports such as: Philadelphia Fed Manufacturing Survey and Initial Jobless Claims report. The pair has been moving with bullish bias within the Andrews’ pitchfork and the ascendant channel. The support lies at 0.98880 with resistance at 0.99300 which both lines are above the weekly pivot point at 0.9742. The EMA of 10 is located above the EMA of 50 showing the price growth in the last recent days. All indicators are signaling a buy opportunity, the RSI is above the 50 level, the ADX is showing strong buyers and the MACD indicator is in positive territory. The resistance level breakout will smooth the way for further high targeting 0.9940.

https://fxglory.com/technical-analysis-of-usdchf-dated-20-05-2016/

https://fxglory.com/technical-analysis-of-usdchf-dated-20-05-2016/

Technical analysis of GBPCHF dated 20.05.2016

With no important economic reports in Switzerland, GBPCHF is chiefly under the influence of CBI Trends – Orders. GBPCHF is moving in higher ranges today and there is good chance of hitting 1.4440 soon. The support rests at 1.44135 with resistance at 1.44830 which both lines are above the monthly pivot point at 1.38780. All indicators are showing strong buy signal, the RSI is above the 50 level, the MACD indicator is in positive territory and the ADX is confirming the bullish scenario by suggesting stronger buyers than sellers. The EMA of 10 is sharply moving up above the EMA of 50 showing price growth in the last 10 days. Long positions are recommended with the target at 1.4490 however there would be a pullback after this hit.

https://fxglory.com/technical-analysis-of-gbpchf-dated-20-05-2016/

https://fxglory.com/technical-analysis-of-gbpchf-dated-20-05-2016/

Thursday, May 19, 2016

Technical analysis of EURJPY dated 19.05.2016

EURJPY is under the influence of some economic reports such as Spanish 10-y Bond Auction, French 10-y Bond Auction and ECB Monetary Policy Meeting Accounts for EUR and Industries Activity m/m and Core Machinery Orders m/m for JPY. The chart has been choppy during this week moving in the neutral area but considering this month it has been moving with bullish bias. The support lies at 123.160 with resistance at 123.920 which both lines are above the weekly pivot point at 122.950. The MACD indicator and the RSI are in neutral zone not providing any signals for traders. Moreover the EMA of 10 has met the EMA of 50 at the same spot. There is no clear signal for EURJPY at the moment, traders should wait for a better chart setup.

https://fxglory.com/technical-analysis-of-eurjpy-dated-19-05-2016/

https://fxglory.com/technical-analysis-of-eurjpy-dated-19-05-2016/

Technical analysis of USDJPY dated 19.05.2016

USDJPY is under the influence of some economic data in the US and Japan such as: Natural Gas Storage, Unemployment Claims, Philly Fed Manufacturing Index, CB Leading Index m/m, Core Machinery Orders m/m and Industries Activity m/m. USDJPY continued its movement with bullish bias today as well. The support rests at 109.740 with resistance at 110.440 which both lines are above the weekly pivot point at 108.400. The EMA of 10 and 50 are moving with bullish bias as well while EMA of 10 is above the EMA of 50. The MACD indicator is in positive territory and the RSI is above the 50 level. The price is above the Ichimoku Cloud and the Chinkou Span. The Tenkan-sen and the Kijun-sen are both showing an upward movement. Long positions are recommended with the target at 110.60

https://fxglory.com/technical-analysis-of-usdjpy-dated-19-05-2016/

https://fxglory.com/technical-analysis-of-usdjpy-dated-19-05-2016/

Technical analysis of GBPUSD dated 19.05.2016

GBPUSD is affected by England economic data such as Average Earnings including Bonus, Unemployment rate and Claimant Count Change. After GBPUSD growth yesterday there was a pullback this morning but it turned into a bullish trend again. The pair is finding support at 1.45530 with resistance at 1.45990 which both lines are above the weekly pivot point at 1.4383. The EMA of 10 is above the EMA of 50 indicating the price movement in higher ranges in the last recent days. The MACD indicator is in positive territory showing the price growth and the RSI is above the 50 level. According to these indicators, the pair will climb up the ascendant channel creating a new high around the previous high area at 1.47667. However, the Stochastic is signaling a price fall suggesting the price movement along with Andrews’ pitchfork. The buy opportunity seems stronger than the sell therefore long positions are recommended with the target at 1.4760.

https://fxglory.com/technical-analysis-of-gbpusd-dated-19-05-2016/

https://fxglory.com/technical-analysis-of-gbpusd-dated-19-05-2016/

Technical analysis of EURUSD dated 19.05.2016

EURUSD had a small growth yesterday but it started to fall today. EURUSD will be under the influence of CPI report for April. The pair is finding support at 1.12000 with resistance at 1.12380 which both lines are below the weekly pivot point at 1.13250. EURUSD is falling down the descendant channel within Andrews’ pitchfork. The EMA of 10 is located below the EMA of 50 suggesting the price decline over the last 10 days. All indicators are showing price fall; MACD indicator is in negative territory, the RSI is below the 50 level and the Stochastic is confirming this bearish scenario. It seems that buyers cannot take profit of this pair at the moment, short positions are recommended with the target at 1.0821.

https://fxglory.com/technical-analysis-of-eurusd-dated-19-05-2016/

https://fxglory.com/technical-analysis-of-eurusd-dated-19-05-2016/

Wednesday, May 18, 2016

Technical analysis of USDCAD dated 18.05.2016

Canadian Dollar is getting support from the rising price of oil but on the other hand it is getting weak due to the wildfire at Fort McMaurry. USDCAD is finding support at 1.29040 with resistance at 1.29800 which both lines are above the monthly pivot point at 1.27550. All indicators are signaling a strong buying opportunity. The MACD is in positive territory, the RSI is above the 50 level and the Stochastic is confirming the upward trend scenario. The price is rallying within the Andrews’ pitchfork along with the ascendant channel. The EMA of 10 is located above the EMA of 50. The price may push the resistance towards 1.3065 but there will be a pullback after that.

https://fxglory.com/technical-analysis-of-usdcad-dated-18-05-2016/

https://fxglory.com/technical-analysis-of-usdcad-dated-18-05-2016/

Technical analysis of USDCHF dated 18.05.2016

Switzerland is not releasing any economic reports today therefore USDCHF will be chiefly under the influence of macroeconomic news. However, Switzerland’s producer and import price index rose along with the US Consumer price index. USDCHF is expected to move in higher ranges today. The support lies at 0.97940 with resistance at 0.98440 which both lines are above the weekly pivot point at 0.9742. The EMA of 10 is located above the EMA of 50 showing the price growth over the last recent days. All indicators are signaling buy opportunity such as MACD indicator which is in positive territory, the RSI is above the 50 level and the Stochastic is confirming the upward trend as well. USDCHF rally within the ascendant channel will continue for today. Long positions are recommended with the target at 0.9890.

https://fxglory.com/technical-analysis-of-usdchf-dated-18-05-2016/

https://fxglory.com/technical-analysis-of-usdchf-dated-18-05-2016/

Technical analysis of EURUSD dated 18.05.2016

USD gained momentum after the US consumer prices growth. Moreover the US industrial production and the nation’s housing have risen as well. On the other hand, there was no important economic news in Europe. EURUSD started its bearish journey yesterday and has been falling down since then. The support rests at 1.12650 with resistance at 1.13230 which both lines are below the monthly pivot point at 1.13740. The EMA of 10 is below the EMA of 50 suggesting the recent price fall. All indicators are signaling strong sell opportunity; the MACD indicator is in negative territory, the RSI is below the 50 level and the Stochastic is showing a downward trend. The price is under the Ichimoku Cloud and the Chinkou Span. The Tenkan-sen and the Kijun-sen are showing a horizontal movement. Short positions are recommended with the target at 1.1150.

https://fxglory.com/technical-analysis-of-eurusd-dated-18-05-2016/

https://fxglory.com/technical-analysis-of-eurusd-dated-18-05-2016/

Technical analysis of GBPUSD dated 18.05.2016

GBPUSD is under the influence of Consumer Price index for April and the UK 10-year government bonds yield. The US is also publishing Oil related reports therefore the market would be more volatile. The pair started its movement with bullish bias yesterday but after touching 1.45222 it turned into a bearish pattern. It has already created a double top and might create its double bottom as well. The support rests at 1.44220 with resistance at 1.44540 which both lines are above the weekly pivot point at 1.43830. The EMA of 10 is staying at the same spot as the EMA of 50. The MACD indicator and the RSI are in neutral zone without any clear signal for traders but the Stochastic is suggesting downward trend. The support level breakthrough will be a good sign for sellers because the price may go lower touching 1.4089 otherwise, the resistance breakout can pave the way for a new high almost close to 1.47667 area.

https://fxglory.com/technical-analysis-of-gbpusd-dated-18-05-2016/

https://fxglory.com/technical-analysis-of-gbpusd-dated-18-05-2016/

Tuesday, May 17, 2016

Technical analysis of AUDUSD dated 17.05.2016

AUDUSD is affected by two major economic reports in the US as Building Permits and Core CPI for April. The pair tried to rally and move in higher ranges yesterday but could not go beyond 0.73619 and created a strong resistance there. The resistance level breakout can push the line higher targeting 0.7400. The support lies at 0.73050 with resistance at 0.73870 which both lines are below the monthly pivot point at 0.76440. The EMA of 10 is moving below the EMA 50 showing the price fall in the last 10 days. The RSI is presenting a buy signal while the MACD is still in negative territory. The Stochastic signal is not clear yet but it is showing upward tendency. If the pair follows the Andrews’ pitchfork then it would be testing 0.6826 on the downside and on the other hand the resistance level breakout will create a good buy opportunity for buyers.

https://fxglory.com/technical-analysis-of-audusd-dated-17-05-2016/

https://fxglory.com/technical-analysis-of-audusd-dated-17-05-2016/

Technical analysis of GBPUSD dated 17.05.2016

GBPUSD is under the influence of Empire State Manufacturing Index in the US and Housing Price index for May in the UK. GBPUSD is staying neutral for the moment moving in neutral area. It is finding support at 1.43690 with resistance at 1.44290 and the weekly pivot point is located in between at 1.4383. Considering the short term pattern the pair is rallying upward while considering the long term pattern it is falling down the descendant channel. The EMA of 10 is staying below the EMA of 50 showing the price movement in lower ranges for the past 10 days. The indicators are not suggesting any strong ideas; the MACD indicator is in negative zone, the RSI is in neutral area and the stochastic is showing upward momentum. Due to opposing signals by indicators it would be better for traders to give this chart a rest and wait for a better chart setup.

https://fxglory.com/technical-analysis-of-gbpusd-dated-17-05-2016/

https://fxglory.com/technical-analysis-of-gbpusd-dated-17-05-2016/

Technical analysis of EURUSD dated 17.05.2016

EUR lost its momentum due to the Germany 10-year government bonds yield decline and on the other hand, many European markets were closed so there were not any effective economic reports. EURUSD has been moving with bearish bias within the descendant channel since 3rd of May and is finding support at 1.12960 with resistance at 1.13440 and the weekly pivot point is staying in between at 1.13250. The EMA of 10 is located below the EMA of 50 suggesting the price movement in lower ranges in the past 10 days. All indicators are showing price decline; the MACD is in negative territory, the RSI is below the 50 zone and the Stochastic is showing negative momentum. The bears will stay at this chart to touch 1.1260 level.

https://fxglory.com/technical-analysis-of-eurusd-dated-17-05-2016/

https://fxglory.com/technical-analysis-of-eurusd-dated-17-05-2016/

Technical analysis of USDJPY dated 17.05.2016

USDJPY is mainly influenced by the price index for corporate goods in Japan which surprisingly fell. The pair is finding support at 108.870 with resistance at 109.170 which both lines are above the weekly pivot point at 108.400. It seems that the price is climbing up the ascendant channel and as EMA of 10 is above the EMA of 50 it confirms the recent price growth. The RSI is above the 50 level and the MACD indicator is in positive territory showing the price rally upward. Moreover the Stochastic is signaling upward trend as well. The pair is moving with bullish bias therefore long positions are recommended with the target at 109.80.

https://fxglory.com/technical-analysis-of-usdjpy-dated-17-05-2016/

https://fxglory.com/technical-analysis-of-usdjpy-dated-17-05-2016/

Monday, May 16, 2016

Technical analysis of NZDUSD dated 16.05.2016

There are several different economic news factors in the US to affect all the pairs consisting of greenback. For NZDUSD it seems that this pair is willing to trade in lower ranges for today. The support lies at 0.67530 with resistance at 0.68190 which both lines are below the monthly pivot point at 0.69300. Both EMA of 10 and 50 are moving with bearish bias plus the EMA of 10 is lower than EMA 50 which shows the current price decline. The RSI is staying in neutral zone but the MACD indicator is in negative territory and the stochastic is showing price growth. There is no clear signal for traders to decide on this pair so it might be a good idea to wait for a better chart setting. However the support level breakthrough can pave the way for 0.6710 and the resistance breakout can push the pair towards 0.6830.

https://fxglory.com/technical-analysis-of-nzdusd-dated-16-05-2016/

https://fxglory.com/technical-analysis-of-nzdusd-dated-16-05-2016/

Technical analysis of USDCHF dated 16.05.2016

The US economic news is deciding more on USDCHF for today. USDCHF is moving with more strength climbing up the ascendant channel within the Andrews’ pitchfork. The support lies at 0.97490 with resistance at 0.97730 which both lines are above the monthly pivot point at 0.96280. The EMA of 10 is going up above the EMA of 50. All indicators are presenting buy opportunity. The MACD indicator is in positive territory, the RSI is above the neutral zone and the ADX is showing stronger buyers. After the resistance level breakout the pair might touch 1.0091 and keep its movement with bearish bias. Long positions are recommended with the target at 1.0091.

https://fxglory.com/technical-analysis-of-usdchf-dated-16-05-2016/

https://fxglory.com/technical-analysis-of-usdchf-dated-16-05-2016/

Technical analysis of GBPUSD dated 16.05.2016

Britain is not publishing any economic news today and GBPUSD will be more influenced by economic data in the US such as Consumer Sentiment Index from Michigan University and Retail Sales for April. Furthermore the oil price affects this pair as well. The support rests at 1.43370 with resistance at 1.43830 which both lines are below the monthly pivot point at 1.44260. The pair is falling down the descendant channel. All indicators confirm the sell signal, the MACD is in negative territory, the RSI is below the 50 level and the ADX is showing stronger sell opportunity than buy. The EMA of 10 is staying below the EMA of 50 suggesting the price fall over the last recent days. The support level breakthrough will smooth the way for further decline to 1.4240.

https://fxglory.com/technical-analysis-of-gbpusd-dated-16-05-2016/

https://fxglory.com/technical-analysis-of-gbpusd-dated-16-05-2016/

Technical analysis of EURUSD dated 16.05.2016

EURUSD is chiefly affected by the US economic news since there is no special report in Eurozone for today. The US is announcing and Empire State Manufacturing Index, TIC Long-Term Purchases and NAHB Housing Market Index. EURUSD is moving with bearish bias creating support at 1.12960 with resistance at 1.13220 which both lines are below the monthly pivot point at 1.13740. The EMA of 10 is located below the EMA of 50 suggesting the price decline in the last recent days. All indicators are signaling sell opportunity such as MACD which is in negative territory, the RSI is below 50 and the ADX is showing strong sellers. Sellers can expect the price to touch 1.1150.

https://fxglory.com/technical-analysis-of-eurusd-dated-16-05-2016/

https://fxglory.com/technical-analysis-of-eurusd-dated-16-05-2016/

Friday, May 13, 2016

Technical analysis of USDCAD dated 13.05.2016

USDCAD is chiefly affected by Canada’s housing price index and for today there is no economic news in Canada. Market will be more active next week with the release of nation’s consumer price index, retail sales and BoC review report. The pair is finding support at 1.28290 with resistance at 1.28790 which both lines are above the weekly pivot point at 1.27720. The pair might fall down the descendant channel creating another bottom at 1.24610. The price is expected to move in lower ranges due to the oil market as well. Moreover the MACD indicator and the RSI are in neutral zone but the ADX is showing strong buyers suggesting that the price will follow the Andrews’ pitchfork. There is no clear signal at the moment so traders can wait for a better chart setup.

https://fxglory.com/technical-analysis-of-usdcad-dated-13-05-2016/

https://fxglory.com/technical-analysis-of-usdcad-dated-13-05-2016/

Technical analysis of USDJPY dated 13.05.2016

Today USDJPY is under the influence of some economic news reports such as M2 Money Stock y/y and Tertiary Industry Activity m/m in Japan and the US is announcing Core Retail Sales m/m, Business Inventories m/m, the Revised UoM Inflation Expectations and Retail Sales m/m therefore this pair will be more active. USDJPY is finding support at 108.59 with resistance at 109.050 which both lines are above the weekly pivot point at 106.690. The pair is climbing the ascendant channel. The EMA of 10 is moving above the EMA of 50 suggesting the price growth over the last recent days. All indicators are showing buy signal; the price is above the Ichimoku Cloud and the Chinkou Span. The Kijun-sen and the Tenkan-sen show a horizontal movement. The MACD indicator is in positive territory confirming the buy signal and the RSI is above the 50 level. The resistance breakout will pave the way for 109.80.

https://fxglory.com/technical-analysis-of-usdjpy-dated-13-05-2016/

https://fxglory.com/technical-analysis-of-usdjpy-dated-13-05-2016/

Subscribe to:

Posts (Atom)